At the stroke of midnight tonight, Prime Minister Narendra Modi will launch GST -- India's biggest tax reform ever since Independence, fittingly at a grand ceremony in Parliament's central hall.

When India wakes up tomorrow, it would have changed forever. At the stroke of midnight tonight, Prime Minister Narendra Modi will launch GST — India’s biggest tax reform ever since Independence, fittingly at a grand ceremony in Parliament’s central hall, where Jawahar Lal Nehru gave his famous ‘Tryst with destiny’ speech in 1947 to mark the country’s independence from the British rule. Here are some key questions and their answers on the revolutionary tax system.

What is GST?

GST is India’s biggest ever tax reform ever since Independence and had been in making 17 years. It impacts everyone from the biggest industries and the richest businessmen to a small shopkeeper and a commoner in your neighbourhood — even those who do not pay income tax! GST subsumes over 15 different taxes and levies, and unifies the entire country into one common market with a single tax structure, making the movement of goods easier and seamless across state and territorial borders. With GST, all goods and services sold across various states of India will be taxed at a uniform rate, with all the income accruing to the Central government, which thereafter will compensate states for revenue lost due to tax forgone. Since the states will not be responsible for any of the indirect tax collection, trucks carrying the goods across states will not be stopped at check posts. The GST Council has made four primary tax rate slabs for various items — low rate of 5%, standard rates of 12% and 18%, and high rate of 28%. Other than this, gold and jewelry will be taxed at a concessional GST rate of 3%, while rough diamonds will attract a 0.25% levy. The government has also chosen to keep certain essential items of daily use free from any tax levy under GST.

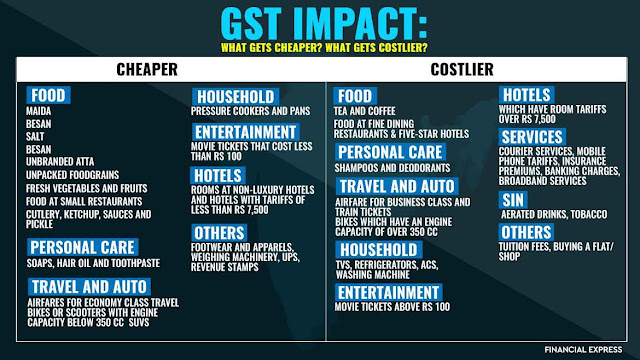

Will it make things cheaper or costlier?

At this moment, it’s difficult to say, regardless of the several speculations and calculations being put forth by various sections. Finance Minister Arun Jaitley has repeatedly said that the government has kept in mind that the tax burden under GST does not exceed the tax incidence on various items at present, when it fixed the tax rate on 1,211 goods and about 600 services. Nevertheless, if one were to compare just the sticker tax rate under GST with the current tax rate, then some of the items which could become costlier include shampoos and deodorants, eating at fine dining restaurants, business class air travel, TVs, refrigerators, air conditioners, washing machines, five star hotel stays, mobile and broadband services, banking and financial services, and more. Although, the provision of input tax credit may offset some of the increment. On the other hand, items on which GST rate is lower than the current tax rate include salt, unbranded flour, unpackaged foodgrains, fresh fruits and vegetables, soaps, hair oil, toothpaste, pressure cookers and pans, non luxury hotel stays, education, healthcare and more.

How will it benefit, and whom?

GST seeks to benefit everyone, but the biggest impact will be felt by businesses, especially those engaged in buying or selling of goods from or into other states. With the onset of GST, any trader would be able to buy goods from anywhere in India, with logistics remaining the only factor and not the state taxation. It will help producers sell more goods, who sometimes find it difficult to sell stuff to distributors or wholesalers in other states because of a difference in tax rates and cumbersome movement of goods. Also, notably, since there will be no stopping at the state borders, it will significantly cut the time spent and cost incurred on movement of goods. Further, GST seeks to build a complete chain of tax payments at each stage of sale, due to its value-added taxation nature. This will lead to a huge reduction in tax evasion as the entire ecosystem increasingly gets into the tax net, which will eventually boost the government revenue, leaving it with more money to spend on development. Further, the increased business activity and the erstwhile unorganised activity becoming formalised will boost India’s economy as a whole.

What happens going forward?

After a ceremonious rollout of GST at midnight tonight in Parliament’s central hall by Prime Minister Narendra Modi, all businesses across India will move to the new system tomorrow onwards itself. As is expected from any revolutionary change, there is a lot of opposition to GST too, with some business lobbies asking to delay the rollout for more time to prepare for it, and some others asking for scrapping it altogether due to fears of increased compliance burden and increasing use of technology. However, the finance ministry has indicated that the government would not take penal action for compliance lapses in the first few months of the rollout. GST in its current form in India, with multiple tax slabs and few items out of its ambit, is not an ideal tax solution which was sought earlier – a single tax rate across everything. But the government’s goal is to eventually move in that direction gradually and converge various tax slabs at later stages.

Courtesy: FE

Courtesy: FE

Comments

Post a Comment