Here’s a look at how GST impact people’s expenditure on most commonly used items in their day-to-day lives.

With the massive change in the way all the goods and services are taxed in India, it would be good to know which items will not be taxed at all. The GST Council has made four primary tax rate slabs for various items — low rate of 5%, standard rates of 12% and 18%, and high rate of 28%. Other than this, gold and jewelry will be taxed at a concessional GST rate of 3%, while rough diamonds will attract a 0.25% levy. Further, the government has chosen to keep certain essential items of daily use free from any tax levy under GST. With the revolutionary tax set to enter into all our lives tonight on a mind-boggling 1,211 items and about 600 services in the list with multiple tax slabs, here’s a look at how will it impact people’s expenditure on most commonly used items in their day-to-day lives.

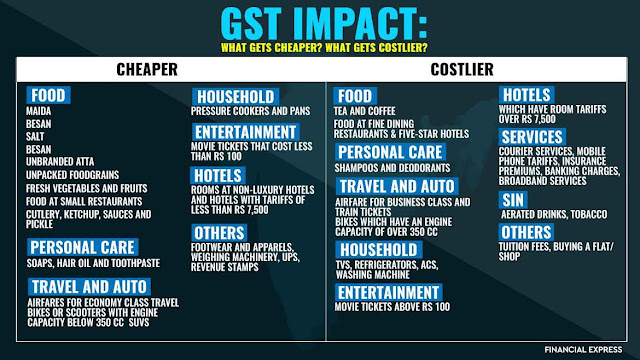

What could get cheaper under GST?

Food: Unpacked foodgrains, unbranded atta, maida, besan, fresh vegetables and fruits, salt, food at small restaurants, cutlery, ketchup, sauces and pickle. Personal Care: Soaps, hair oil and toothpaste. Travel and Auto: Airfares for economy class travel, bikes or scooters with engine capacity below 350 cc and SUVs. Household: Pressure cookers and pans. Entertainment: Movie tickets that cost less than Rs 100. Hotels: Rooms at non-luxury hotels and hotels with tariffs of less than Rs 7,500. Others: Footwear and Apparels, Weighing machinery, UPS, revenue stamps.

What could get costlier under GST?

Food: Packaged or branded and coffee, food at fine dining restaurants or those inside five-star hotels. Personal Care: shampoos and deodorants. Travel and Auto: Airfare for business class and train tickets, bikes which have an engine capacity of over 350 cc. Household: TVs, refrigerators, ACs, washing machine. Entertainment: Movie tickets above Rs 100. Hotels: Hotels which have room tariffs over Rs 7,500. Services: Courier services, mobile phone tariffs, insurance premiums, banking charges, broadband services. Sin goods: Aerated drinks, tobacco and luxury goods. Others: Mobile bills, tuition fees, salon visits and buying a flat or shop.

What remains tax free under GST

Salt, eggs, milk, buttermilk, unpackaged curd, natural honey, fresh fruits and vegetables, flour, besan, bread, prasad, lassi, unpacked paneer, fresh meat, fish, chicken, palmyra jaggery, hulled cereal grains, unbranded and unpackaged tea and coffee, vegetable oil, children’s picture, drawing or colouring books, muddhas made of sarkanda and phool bahari jhadoo, jute, kajal (other than kajal pencil sticks), bindi, sindoor, bangles, handloom, stamps, judicial papers, printed books, newspapers, unbranded dried leguminous vegetables, silkworm laying, raw silk, silk waste, uncarded or uncombed wool, Gandhi topi, khadi yarn, coconut, coir fibre, unspun jute fibres, Indian national flag, Puja items, prasad, contraceptives, hotels and lodges with tariff below Rs 1,000, education and healthcare services.

What will be taxed at what rate under GST?

0.25% / 3% Tax

Rough precious and semi-precious stones will be taxed at the rate of 0.25%. Finance Minister Arun Jaitley has said that this will facilitate in keeping an audit trail. Gold, gems and jewelry will be taxed at the rate of 3%, which is lower than the lowest slab of 5% under the new GST regime and is closer to the current tax incidence of about 2%.

5% Tax

Items such as cashew nut, raisin, biogas, insulin, agarbatti, kites, coir mats, matting and floor covering, postage or revenue stamps, hearing aids, fish fillet, apparel below Rs 1,000, packaged food items, footwear below Rs 500, cream, skimmed milk powder, branded paneer, frozen vegetables, coffee, tea, spices, pizza bread, rusk, sabudana, kerosene, coal, medicines, stent, lifeboats, transport services (railways, air transport), small restaurants with revenue less than Rs 75,00,000 per year will be under the 5% category.

12% Tax

All diagnostic kits and reagents, exercise books and notebooks, glasses for corrective spectacles, spoons, forks, fish knives, tongs, fixed speed diesel engines, two-way radio (walkie-talkie) used by defence, police and paramilitary forces etc., corrective spectacles, intraocular lens, playing cards, chess board, carom board and other board games, like ludo, etc., apparel above Rs 1,000, frozen meat products, butter, cheese, ghee, dry fruits in packaged form, animal fat, sausage, fruit juices, namkeen, Ayurvedic medicines, tooth powder, agarbatti, colouring books, picture books, umbrella, sewing machine, cell phones, non-AC hotels, business class air ticket, fertilisers, work contracts will fall under 12 percent GST tax slab.

18% Tax

Aluminium foil, curry paste; mayonnaise and salad dressings; mixed condiments and mixed seasonings, kajal pencil sticks, dental wax, school bags (other than leather or composition leather), precast concrete pipes, tractor rear tyres, tubes and wheel rim, printers [other than multifunction printers], Ball bearing, Roller Bearings, Parts & related accessories, electrical transformer, CCTV, footwear costing more than Rs 500, bidi patta, biscuits (all categories), flavoured refined sugar, pasta, cornflakes, pastries and cakes, preserved vegetables, jams, sauces, soups, ice cream, instant food mixes, mineral water, tissues, envelopes, tampons, notebooks, steel products, printed circuits, camera, speakers and monitors, branded garments, AC restaurants that serve liquor, telecom services, IT services, hotel accommodation with room tariff at Rs 2,500-7,500 per day, dining in air-conditioned restaurants or those in five-star hotels, movie tickets less than Rs 100, construction and financial services will attract 18 per cent tax under GST.

28% Tax

Alcohol, bidis, cigarettes, cigars, chewing gum, molasses, chocolate not containing cocoa, waffles and wafers coated with chocolate, pan masala, aerated water, paint, deodorants, shaving creams, after shave, hair shampoo, dye, sunscreen, wallpaper, ceramic tiles, water heater, dishwasher, weighing machine, washing machine, ATM, vending machines, vacuum cleaner, shavers, hair clippers, automobiles, motorcycles, aircraft for personal use, 5-star hotels, hotel accommodation with room tariff above Rs 7,500 per day, race club betting, cinema tickets above Rs 100 will attract tax 28 per cent tax slab under GST.

Courtesy: FE

Courtesy: FE

Comments

Post a Comment