Understanding the Sovereign Gold Bond Scheme

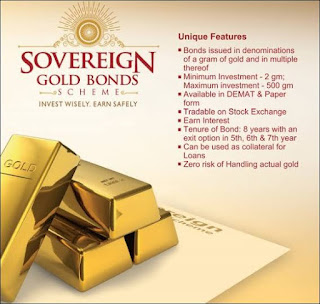

Understanding the Sovereign Gold Bond Scheme Sovereign Gold Bonds will be denominated in the multiples of a gram of gold with the minimum unit of 1 gram. The interest for the gold bonds will be 2.50% per annum which is payable semi-annually on the nominal value. The tenure of the bond will be for a period of 8 years with an exit option available in the 5th, 6th and 7th year on the dates of interest payment. The maximum limit of gold which can be subscribed by an individual is 4 kg for, 4 kg for a Hindu-Undivided Family and 20 kg for trusts and other similar entities. If the gold bonds are co-owned, the limit of investment will be 4kg which will be applied to the first applicant only. The gold bonds will be issued as stocks under the Government Security Act, 2006. The investors will also be given a Holding Certificate for the same. Gold in India is considered auspicious and its demand does not stop at its market value. The precious metal is bought on auspicious occasions as an investmen