The curious case of Ruchi Soya shares

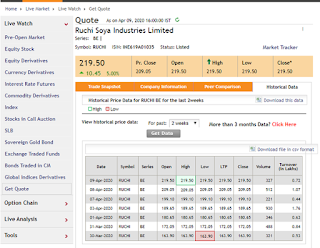

The curious case of Ruchi Soya shares: Ruchi shares, which were relisted at Rs 17 after equity restructuring, have been locked at the upper circuit for the past 70 trading sessions since January 27. It has been a dream run for investors in Nutrela-maker Ruchi Soya stock as it has delivered more than 8,800 per cent returns in the last five months, climbing to an all-time high of Rs 1,507.30 on June 26 compared to its relisting price of Rs 16.9 on January 27, 2020 on the BSE.In contrast, the benchmark S&P BSE Sensex has fallen 14.45 per cent during the same period. After completing the resolution process under the bankruptcy law, Ruchi Soya Industries' shares resumed trading on January 27, 2020, when it was re-listed on the stock exchanges after consolidation of equity shares of the company. On January 27, Ruchi Soya shares were valued at Rs 16.9 per share, but in just 5 months, they rose to hit a record high of Rs 1,507.30 per share today. Turnaround after debt restructuring and