Alert Citizens Forum is pleased that its efforts and follow up to provide relief to the small depositors have now borne full fruit.

Last year, the Finance Minister first announced the increase in Bank Deposit Insurance from Rs 1 lakh to Rs 5 lakhs.

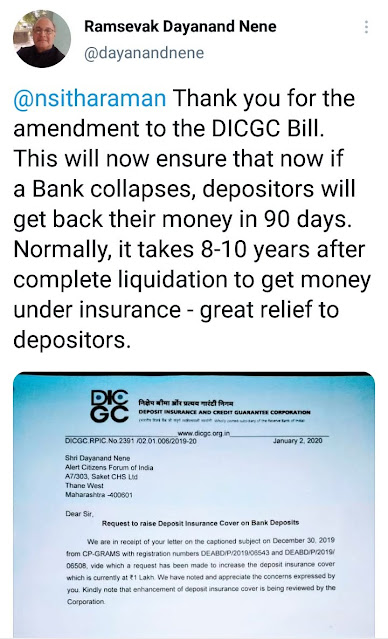

Now, this year, in a relief to depositors of stressed banks, the Cabinet on July 28, cleared amendments to the Deposit Insurance Credit Guarantee Corporation (DICGC) Act, which will enable customers to have access to their deposits up to Rs 5 lakh within just 90 days, if their banks go bust and are placed under moratorium.

The Cabinet also approved amendments to the limited liability partnership (LLP) Act to decriminalise a dozen offences and enable such entities to enjoy the same benefits as large companies—a decision that is expected to help hundreds of start-ups, among others.

Briefing reporters, finance and corporate affairs minister Nirmala Sitharaman said the DICGC (amendment) Bill will cover 98.3% of depositors and 50.9% of deposit value in the banking system, way above the global level of 80% and 20-30%, respectively.

Comments

Post a Comment