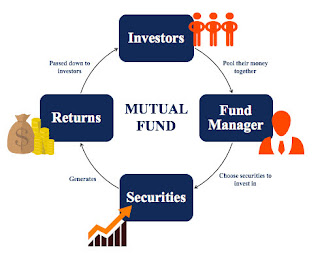

To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic level. Essentially, the money pooled in by a large number of people (or investors) is what makes up a Mutual Fund. This fund is managed by a professional fund manager.

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV.

Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

Benefits of Investing in a Mutual Fund:

Many of us dread the thought of managing our own investments. With a professional fund management company, people are put in charge of various functions based on their education, experience and skills.

As an investor, you can either manage your finances yourself, or hire a professional firm. You opt for the latter when:

You do not know how to do the job best – many of us hire someone to file our income tax returns, or almost all of us get an architect to do our house.

You do not have enough time or inclination. It’s like hiring drivers even though we know how to drive.

When you are likely to save money by outsourcing the job instead of doing it yourself. Like going on a journey driving your own vehicle is far costlier than taking a train.

You can spend your time for other activities of your choice / liking

Professional fund management is one of the best benefits of Mutual Funds. The infographic on the left highlights all the others. Given these benefits, there is no reason why one should look at any other investment avenue.

How to choose a Mutual Fund:

Once an investor has decided to invest in Mutual Funds, he has to make a decision of which scheme to invest in– Fixed Income Fund, Equity Fund or Balanced and which Asset Management Company (AMC) to invest with?

Firstly, discuss freely with your advisor what your objective is, what time period you’re comfortable with, and what your risk appetite is.

Decisions on which fund to invest in would be made based on this information.

If you have a long term objective – say, retirement planning, and are willing to assume some risk, then an Equity or Balanced Fund would be ideal.

If you have a very short term objective – say, money to be kept aside for a couple of months; a Liquid Fund would be ideal.

If the idea is to generate regular income, then a Monthly Income Plan or an Income Fund would be recommended.

After deciding on the type of fund to invest in, a decision on the specific scheme from an AMC would have to be made. These decisions are usually made after ascertaining the AMC’s track record, suitability of scheme, portfolio details, etc.

Scheme Factsheets and Key Information Memorandum are two documents that every investor needs to peruse before investing. If one needs detailed information then one should look at Scheme Information Document. All of these are easily accessible at every Mutual Fund’s website.

Comments

Post a Comment